The use of data systems in operations is rising fast. It will therefore not surprise anyone that the demand is also rising for a truly mission-critical radiocommunications data solution to go alongside the existing mission-critical voice/signalling/telemetry solutions. The operational radiocommunications sector will have to find a way to meet this demand.

Until recently, the majority of data applications handled lower-priority items that could be satisfactorily carried by the public networks. But operations are becoming ever-more integrated. This implies that there is a real need for mission-critical data solutions.

Add in the already large and still increasing trend towards lone-working and you get what could be a very significant market shift towards mission-critical data for operational use.

Public mobile networks, despite advances in technology, are still subject to cost constraints, which make deployment in some areas uneconomical. Similarly, data is difficult to monetise. Ever-bigger data packages are meeting the demand for entertainment and social use. But the top-line income is not growing to match.

Happily, some organisations offer solutions based on the public mobile networks under special arrangements whereby the resilience is improved. However, there are users who would not or could not accept such a solution for a variety of reasons.

Operational radiocommunications markets are different from the consumer world. Systems are bought because they solve a problem which is part of a much bigger picture or because of the need to achieve some improvement in efficiency (often both). So, the business case is self-contained and pretty clear.

In all cases, the key question that needs to be answered is “what is it that you need to do in the future that you cannot do with your existing radio spectrum resource?”. Compared with some other users, those having operational communications needs can often find clear answers to this question.

• There are organisations that must greatly increase the level of automation to maintain the vital services they currently provide. Among other changes, they will need to service thousands of remote sensors where today they only look at a relative handful. The current low data-rate telemetry will not suffice and so they need a much faster data service.

• What do you say to a safety official when one of your people is hurt in an accident and can’t reach the phone on the wall? The old company emergency plan that defined the wall phone as the key emergency system never considered staff would be working alone in the area. Why didn’t you issue your staff with a handheld device that could automatically call for assistance over a resilient data system? That implies possible negligence.

If you doubt the need for high-resilience radio communications, even the simplest analysis will show the cost/performance benefits that can be achieved by moving from an availability (only one of the factors in achieving resilience) of 90 per cent to 99 per cent [see August’s two-way radio SWOT analysis article – Ed].

At this stage in the argument it would be entirely appropriate to ask: “How big is the demand for critical high-speed data services and what’s it worth?” Certainly, that and a host of other questions do need answers. However, the fundamental question is “how could we provide a workable solution to any such demand?”. After all, if there can be no viable solution, it doesn’t matter how big the demand is.

Making properly resilient radio systems is not a trivial matter. Making a properly resilient radiocommunication solution is even less trivial (see FCS2020, the FCS’s guide to this topic, for more detail – https://bit.ly/2TiOqR8). The customer is primarily interested in the extent to which they can rely on having the ability to make a call when needed. Thus, they are interested in the overall resilience of the communications solution. The radio system itself is a vital part of this, but it’s just as important to have adequate power back-up to maintain operation if the supply of power from the grid is interrupted. The technology isn’t the prime issue. When creating resilient solutions, you have to solve the issues in a proper sequence. The first priority is to make sure you have the right radio spectrum to carry the air traffic.

Historically, virtually all the radio spectrum has been taken by other uses and so made completely unavailable. This has had the effect that loads of radio spectrum has been left unused in particular areas. Ofcom has announced its intention to remedy this. It intends to change the principles behind the regulations defining access to the radio spectrum. Having a licence may no longer mean you have exclusive rights over the spectrum everywhere. Where you are not using it, others might be permitted to use it as sharers. Recalling that many business radio deployments are in remote locations, this seems a very easy approach to a difficult problem when providing private-system solutions.

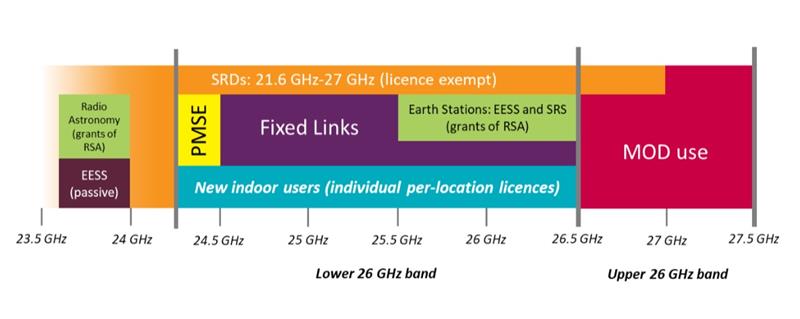

In addition, we now have the drive towards the 5G world. This means new bands at high frequencies are being made available to support it. Although the use of such high frequencies usually implies a coverage problem that directly impacts the cost of the infrastructure, there are situations where this might not be the case. In a recent statement (https://bit.ly/31s6Mmb – paragraph 5.1 and others), Ofcom opened the use of parts of the lower 26GHz band for indoor deployments using a light licensing regime (see the diagram above). The application of a light licensing to the band instead of making it licence-exempt is very important as it means that the quality of the radio spectrum within the room is likely to be much higher, there being only one assignment. At such frequencies, most walls will all but stop the signals. Thus, while the band is clearly being shared as far as the national regulations are concerned, in that room, the user will have uncontested access to a very high-data-rate resource.

As the interference environment will be controlled through ‘light licensing’, it is likely that even consumer equipment, when deployed in conjunction with other essential elements to provide the necessary battery back-up, etc, could be used to provide a cost-effective mission-critical solution.

This approach could be extended to outdoor on-site deployments in the future. The 26GHz band is destined to be examined as one of the candidates for this type of regulation. An Area Defined licensing regime (not necessarily the same as today) would be applied.

Even if 26GHz is not found to be the right solution, there may be other bands which support systems that do not have ubiquitous coverage, and so localised systems might be possible to locate in these spaces.

Thus 5G has become an important matter for the BR community. Not because of service that others might operate but because it might allow the deployment of viable private local systems that could meet indoor and on-site use in the future.

So there may be a short-range solution. But what of radio spectrum that could support wide-area, mission-critical data solutions? Finding sufficient radio spectrum for wide-area, high-data-rate service is not going to be easy, and so fitting additional systems into gaps may not be a viable general approach. Other bands may be needed to support these requirements. There is a lot of work needed in this area.

One of the themes of the FCS Business Radio ’19 conference in November (see www.fcs.org.uk/events/fcs-business-radio-19) is the future markets for operational radiocommunications. What I’ve been discussing – enabling proper, relatively high-speed data services to high levels of resilience – seems to be being catapulted from something the industry knew was needed, but didn’t really know how to get access to the radio spectrum necessary to make it a reality, to a topic where a way forward might now exist. As changes in market potential go, that is a big one.