Ken Hu, Huawei’s deputy chairman, kicked off the event by highlighting the pace of global 5G adoption, saying that by the end of this year there will be more than 60 commercial 5G networks in operation, and that by the end of September there were more than 130 5G devices on the market including both consumer premise equipment solutions (CPEs) and smartphones. Hu also said that in South Korea, where less than six months after the launch of 5G services, 3.5 million people are using 5G, data consumption among early adopters has increased three-fold, up to 1.3GB per month. He also noted the high data consumption requirements of virtual reality and augmented reality services, putting these at around 4GB/10 minutes and 600mb every minute respectively, and said the South Korean carrier LG U+ released 5G-powered VR/AR services as part of its premium data plans. In just three months after 5G launch, its proportion of premium subscribers grew from 3.1 per cent to 5.3 per cent.

Hu then switched to a 5G use-case for mining operations in the Bayan Obo Mining District, in the West of Inner Mongolia – where instead of having to hire four drivers per truck (costing around $160,000/truck/year) and having to drive at less than 10km/h due to safety reasons, a driverless solution has been deployed through co-operation between China Mobile, Huawei and industrial solution providers, saving a great deal of money, increasing the average speed to 35km/hour and ensuring that fewer people are exposed to a dangerous working environment.

Energy use up, CO2 emissions down?

Alex Sinclair, the GSMA’s CTO, said its Intelligence Unit is predicting that by 2025, around 50 per cent of all US connections will be 5G, and there will be 600 million 5G connections in China. The GSMA is also predicting that there is a $620bn opportunity in the vertical industry space for 5G. Turning to network slicing, Sinclair recognised the complexities involved and said GSMA has “analysed about 125 different use-cases for potential slices for potential customers, and that was based on 37 attributes. We have [also] started some work [to] standardise different sets of templates for different verticals.”

While speaking about techniques to reduce network opex, Sinclair said “the cost of energy in [MNOs’] network opex is always significant [and] it’s increasing, with 5G we might see that per site going up by two to three times, so energy efficiency is always going to be incredibly important”. This is perhaps an understatement given that he also said 50 operators have signed up to a global initiative to first disclose their carbon footprints and then try to find a pathway to reduce their emissions to net zero by 2050 without carbon trading.

Let the robots do it

Kalle Lehtinen, CTO, vice president, technology and architecture at Elisa, a Finnish MNO (which debuted 5G services in April, before going live with a commercial service in June), discussed his country’s huge hunger for data. Elisa has seen an 11-fold increase in mobile traffic in six years, 70 per cent of which is video, and at the end of 2018, the MNO was seeing an average of 25GB being consumed per month per subscriber, while fixed household data consumption was around 172GB/month. He added that 36 per cent of households are on mobile-broadband-only data packages. Elisa has priced subscriptions by speed in the form of 300Mbps, 600Mbps and 1Gbps packages, and Lehtinen says that under this model, its customers are seeking to upgrade, as they are getting value from the new services that the extra bandwidth unlocks.

He also highlighted Elisa’s decision to heavily develop its network automation capabilities – the MNO claims to have fully automated fault management, which has reduced network faults by 70 per cent through the use of preventative measures, and it also says 86 per cent of network faults are solved before they become visible to customers. Furthermore, Lehtinen said Elisa has had a 40 per cent increase in data throughput thanks to automated optimisation.

Vodafone Group is also pursuing a tiered speed strategy, according to Matt Beal, its director of technology strategy and architecture. Beal said the group is making sure that as it goes live with 5G in each of the countries it is present in, users in those countries can roam across its entire 5G footprint.

Fake news

Olaf Swantee, CEO of Sunrise (an MNO operating in Switzerland), said that early this year there was a flood of fake news along the lines of ‘5G is killing birds in Holland’, and that this became “really big” in Switzerland. Its CCO, Bruno Duarte, said its approach was to engage with those worried that 5G might cause health issues, and while trying to be as open and transparent as possible, it kept rolling out 5G and ended up getting much less backlash than it did in the beginning. Sunrise also spent a considerable amount of money on a communication campaign to address the concerns.

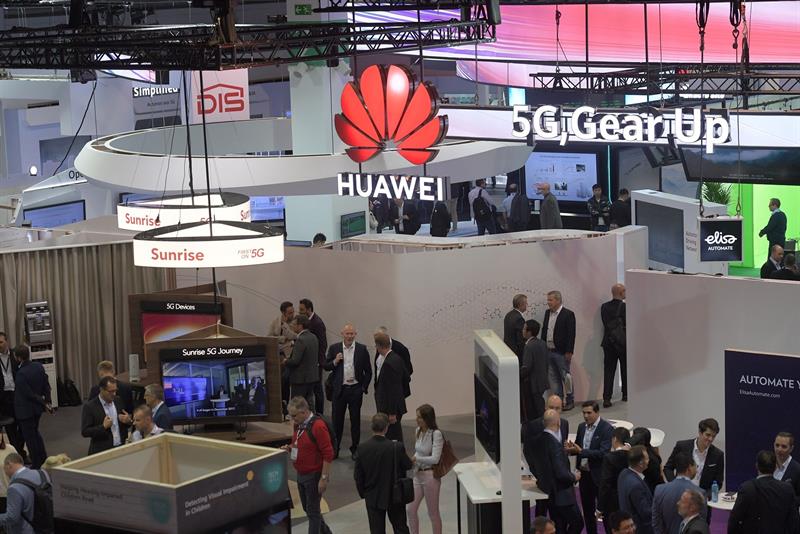

It is worth noting that Sunrise’s 5G network already covers more than 262 towns and cities in Switzerland and the company claims that this serves 80 per cent of the country’s population, and is looking to gradually add 5G coverage to parts of major cities such as Zurich, having initially focused on providing high-speed broadband services to customers who don’t have fibre. The operator has also opened a 5G Joint Innovation Center with Huawei, which includes a Huawei OpenLab that will allow developers to test their 5G applications using a live end-to-end 5G network under real conditions, prior to commercial launch. 5G use-cases that Sunrise is focusing on include smart farming, smart manufacturing, live broadcasting, and cloud-based smartphone gaming.

Speaking of the latter, Juhani Honkala, founder and CEO of Hatch Entertainment, said his company (a cloud gaming company, which is partnering with Vodafone and Samsung) believes that “cloud gaming is the killer app of 5G”. He explained that with 5G “we can offer a completely frictionless playing experience for gamers. [There’s no need to go to an app store, you] can just press play; that’s it, [the game starts instantly].” This helps reduce the number of people lost during the sales funnel, and the use of a cloud platform allows people to be in the same games while using different devices from each other. While his argument must be taken with a grain of salt, if 5G cloud gaming takes off and sufficient value from it can be captured by MNOs (both big ifs), then it is possible that other verticals could benefit from the infrastructure rolled out to support it.

The consumer side of 5G is clearly in full swing, with roll-outs happening at a faster pace than with 4G, and it was interesting to hear about tiered speed-based pricing – given that it allows users to use their devices more freely than compared with traditional data-based packages, while also creating a reason to shift towards more expensive bundles and potentially allowing MNOs to roll out 5G for consumers as more than a customer-retention exercise. With possible further revenue gains from cloud computer gaming and VR/AR – and assuming to some degree that the messages regarding the need for 5G spectrum auctions to offer value of money from MNOs from the likes of the GSMA are heeded by regulators – it may be that 5G escapes the ‘curse’ of the odd-numbered mobile generations, which would be good news for MNOs and the vertical industries they are looking to support via network slicing.